HARRISBURG, Pa. — The Department of Revenue today announced the deadline for taxpayers to file their 2019 Pennsylvania personal income tax returns is extended to July 15, 2020. This means taxpayers will have an additional 90 days to file from the original deadline of April 15. The Internal Revenue Service also extended the federal filing deadline to July 15, 2020.

The Department of Revenue will also waive penalties and interest on 2019 personal income tax payments through the new deadline of July 15, 2020. This extension applies to both final 2019 tax returns and payments, and estimated payments for the first and second quarters of 2020.

The filing deadline is being extended at a time when Governor Tom Wolf has ordered all non-life-sustaining businesses to close to help prevent the spread of COVID-19. Under Pennsylvania law, the filing deadline for personal income tax returns is tied to the federal income tax due date.

"This is a necessary step that will give Pennsylvania taxpayers extra time to file their returns and make tax payments during a difficult time for everyone," Revenue Secretary Dan Hassell said. "Particularly for those who plan to meet with a tax professional to prepare their returns, the new deadline will help everyone follow the Governor's guidance to stay at home as we all work to prevent the spread of the virus."

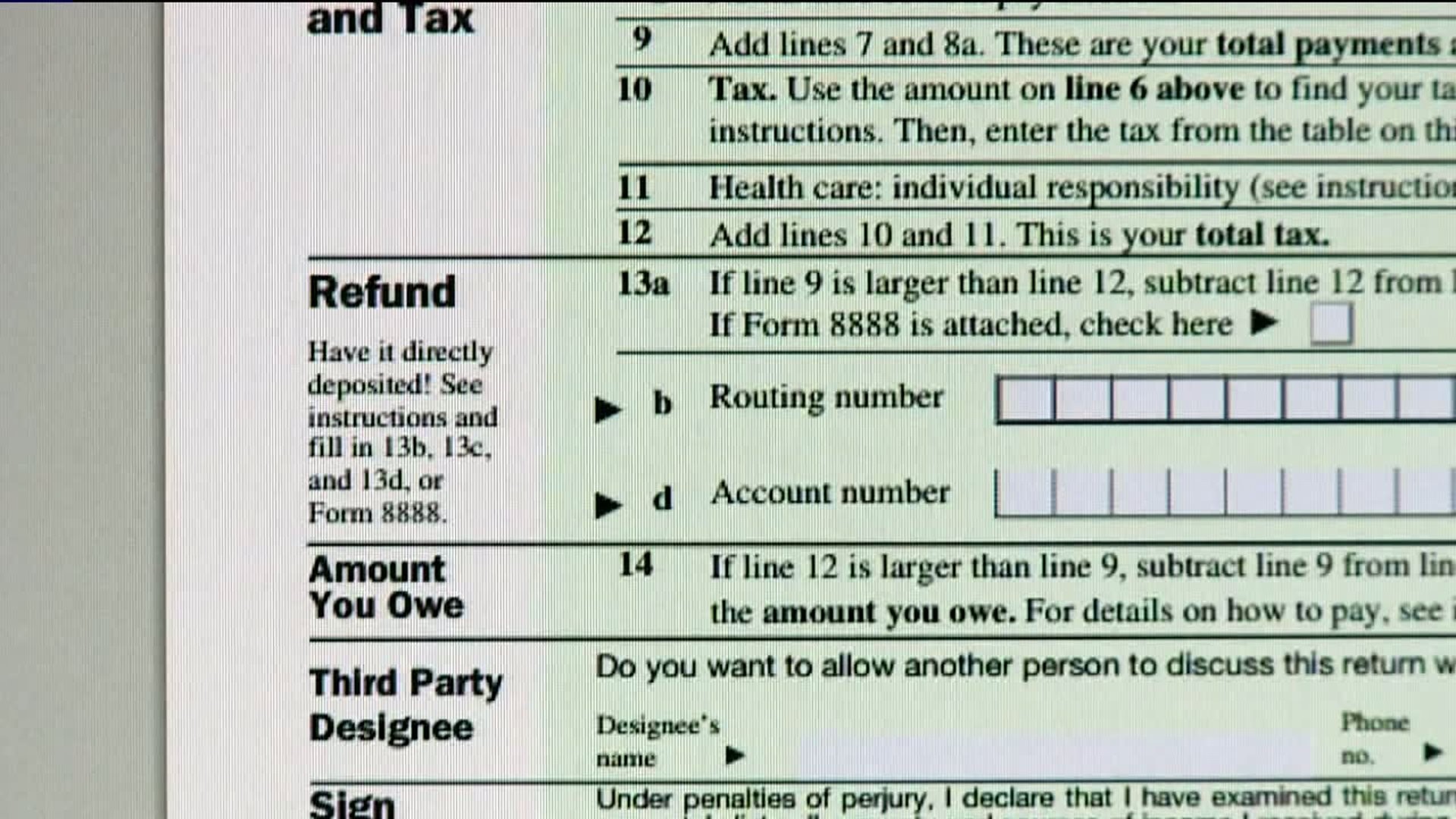

Although the filing deadline has been extended, the Department of Revenue is encouraging taxpayers who are able to file their returns electronically to do so. This will enable the department to continue to process returns as commonwealth offices are closed. Additionally, if you are expecting a refund from the commonwealth, filing electronically will help avoid a delay in the release of your refund.

For more information, visit www.revenue.pa.gov, where you can find free tax forms and instructions.