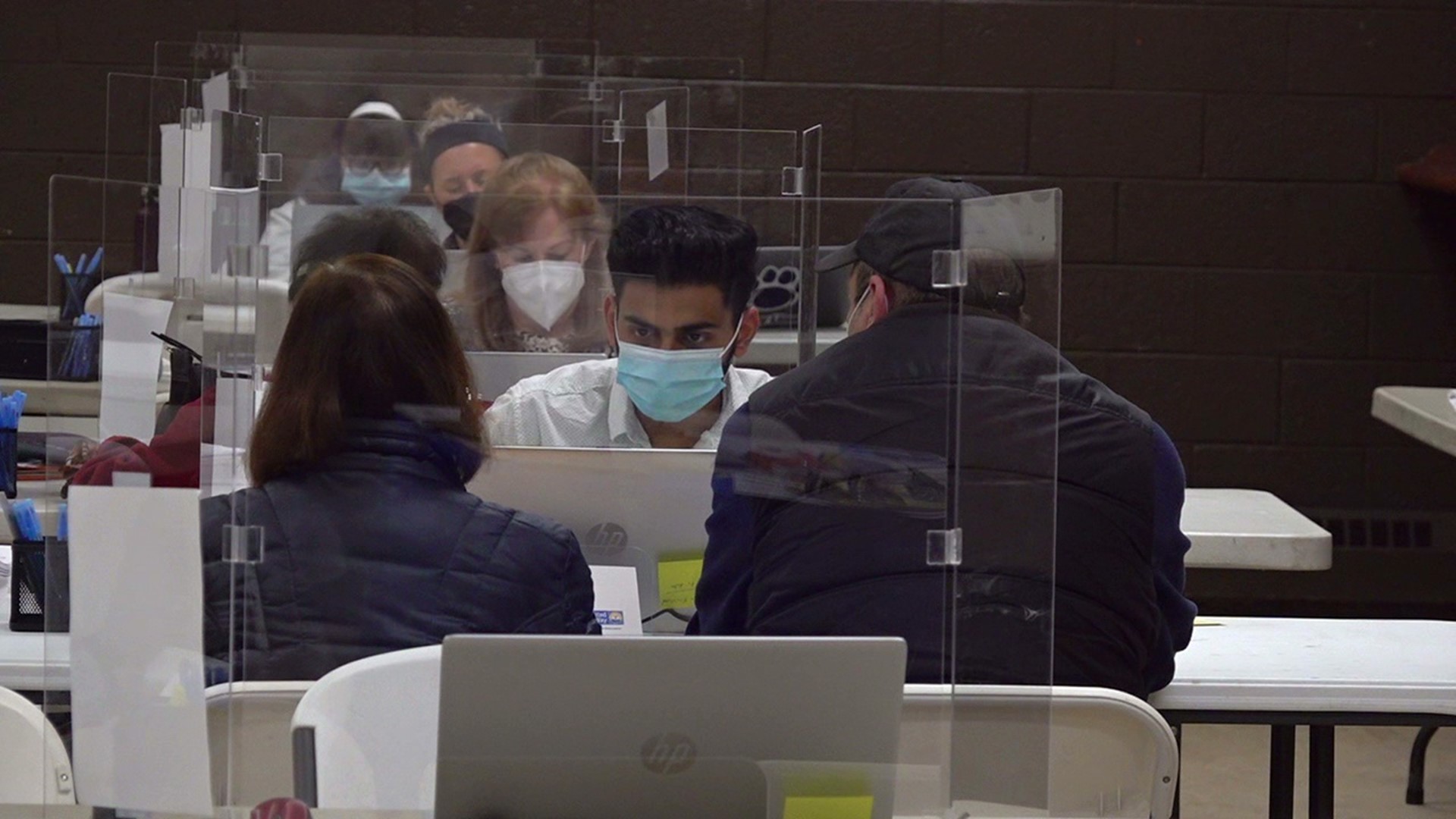

SCRANTON, Pa. — Tables at the Keyser Valley Community Center in Scranton are set up to help people with their taxes. The tables are staffed by volunteers working with the United Way.

"We're really full service, no hassle, and all clients have to do is bring in their documents for the year, and we take care of the rest," said Ricky Kokas, education director for the United Way of Lackawanna and Wayne Counties.

The United Way oversees the VITA tax program. It provides free tax services for qualifying families in Lackawanna and Wayne Counties.

"We have people who have low incomes that can't afford a professional service, so that's why it exists, to help them out during one of the most stressful times of the year," Kokas said.

Volunteers call themselves tax gurus. They take care of federal, state, and local tax returns and make sure clients get all the deductions they deserve.

"It was reported that in Lackawanna County, our citizens and community were not getting the proper amount of income tax credit. People weren't knowing how to file for it," said Kokas.

The volunteers can process anywhere from 60 to 110 tax returns for free every day.

The volunteers here include four accounting students from the Penn State Scranton campus.

"When I first heard 'taxes,' I thought I'm going into accounting, but I'm never going into taxes. It is not what I thought it would be; it's not boring at all. I see people every day and have good chats with them," said Pujan Patel, a tax intern.

"We see people get huge refunds, and then they cry because it really means a lot," Kokas added. "It is the food on the table, gifts for their child's birthday, and clothes for the winter."

Check out WNEP’s YouTube page.