Banks around the country and in our area report that identity theft is on the rise over the holidays because more people are traveling and using their credit and debit cards in a lot more places than usual.

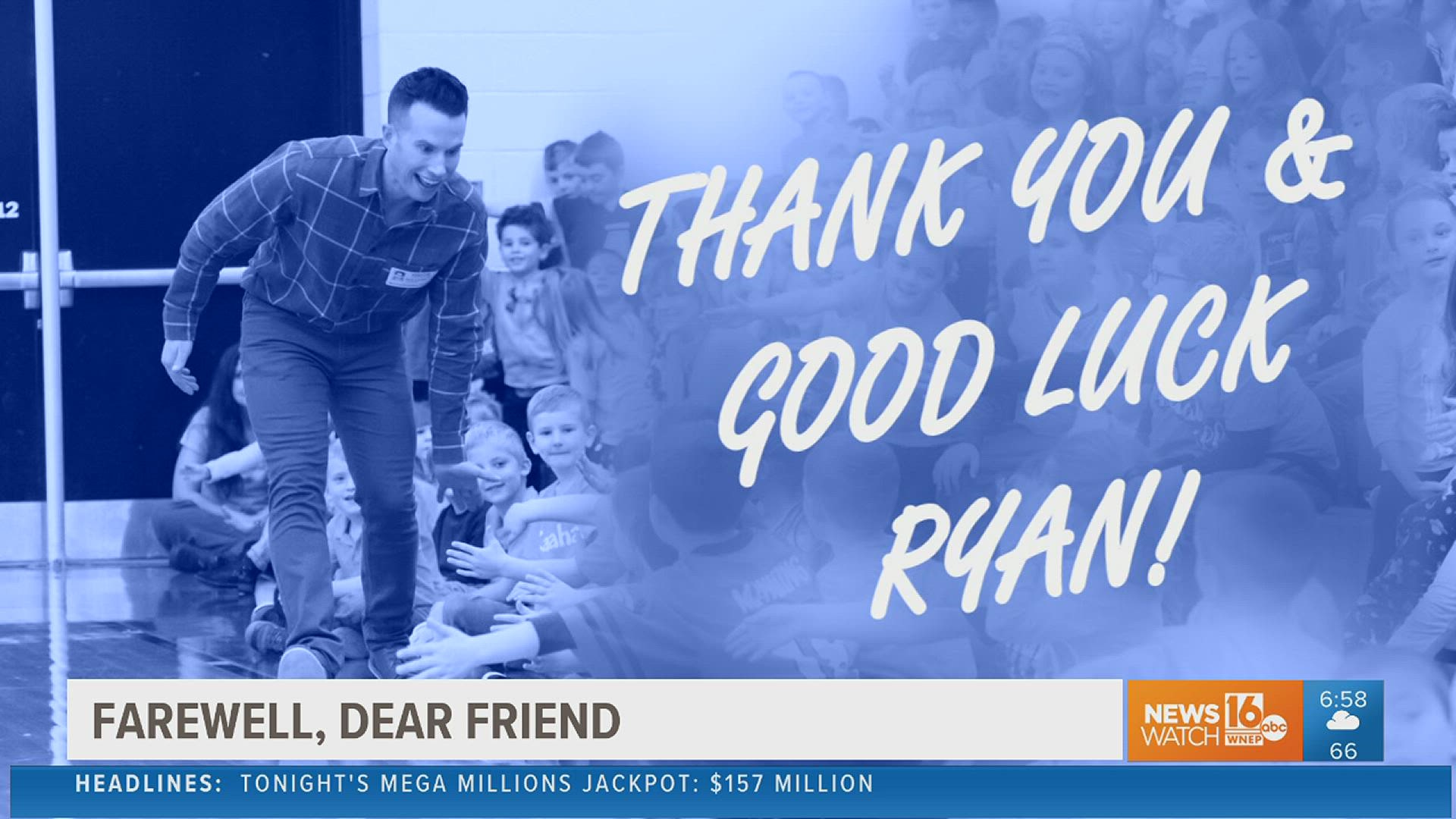

Newswatch 16’s Ryan Leckey tackled this topic with help from the professionals at Fidelity Bank in the Scranton area.

Area bankers warn holiday shoppers to be on the lookout for “skimmers.” They’re people who steal your credit card information by connecting a device to an ATM or another type of card scanner.

To prevent this and other rip-offs while shopping online, the pros suggest setting up mobile alerts from your accounts so you’re notified if certain limits have been spent.

Click here for other tips to avoid being skimmed.

PA Bankers urges consumers to follow the tips below to protect themselves this holiday season:

- Do not share your private information online or over the phone, including your Social Security number, account information, PINs, and passwords. Be sure to use a combination of upper- and lower-case letters, numbers and special characters for your passwords, and change them periodically.

- Shred sensitive papers, such as receipts, banks statements, and unused credit card offers, before throwing them away.

- Keep an eye out for missing mail. Fraudsters look for monthly bank or credit card statements or other mail containing your financial information.

- Consider enrolling in online banking to reduce the likelihood of paper statements being stolen.

- “Snack” on your balance. Monitor your financial accounts regularly for fraudulent transactions. Sign up for text or email alerts from your bank for certain types of transactions, such as online purchases or transactions of more than $500.

- Monitor your credit report. Order a free copy of your credit report every four months from one of the three credit reporting agencies including Experian, Free Credit Report, and Annual Credit Report.

The following are online shopping tips from Fidelity Bank and cybersecurity websites:

-

-

- Avoid Shopping on Hotspots

Try not to do any online shopping when you're using a public computer (such as in an airport lounge) or when you're using a public Wi-Fi network (ex. your favorite coffee shop or in a hotel lobby). You never know if your information is being tracked and logged — so it's best to wait until you get home. Or, use your smartphone as a personal hotspot, which is safer than free Wi-Fi. Always have good anti-malware (“anti-malicious software”) installed to catch threats like viruses. - Look for the Padlock

Always use a secure Internet connection when making a purchase. Reputable websites use technologies such as SSL (Secure Socket Layer) that encrypt data during transmission. Look for the little padlock in the address bar or a URL that starts with “https” instead of “http,” as the “s” stands for “secure.” Some browsers will tell you it’s safe to give out your credit card by showing you a green address bar, while unprotected ones will be highlighted in red. - Use a Strong Password

A strong password is at least seven characters long, has a combination of letters, numbers, and symbols, and with some uppercase characters, too. Change passwords routinely. Or use password management apps if you’re worried you won’t remember the password. It's good to reset your shopping passwords every so often, just in case someone guesses them, or if there’s a data breach at an online retailer. And never use the same password for all online shopping sites (or other Web activities, like online banking), as once someone guesses one password, they’ll have free reign over everything else.

- Do Your Homework

Check the seller’s reputation and read comments before buying a product to see what the experience was like for past customers. You can always ask a question of a seller and reputable ones will reply in a timely manner. Also, read the item description carefully before you buy, including where the seller is located, shipping charges, if the product is new or used, refund and return policies, and payment methods accepted.

- Avoid Shopping on Hotspots

-

Also, don't forget about the No. 1 tip about shopping: If it seems too good to be true, it probably is. Look for the HTTPS designation and before entering any personal or financial information.

Ignore emails or texts that claim to be from a retailer (or your bank or Internet Service Provider). These “phishing” attempts look legit, but it they ask you to confirm your financial or personal details on a website, they’re fake. They’re trying to lure you to click a link in the email, which takes you to an authentic-looking website and fool you into typing in information.

-

-

-

- Think Before You Click

Avoid using promotional links in emails even if it appears to be coming from a site you trust. Watch out for fake delivery notifications or text messages. Criminals are banking on the fake you will be receiving more package delivers during this time of the year. Use the tracking link on your order history page from the website you ordered the items from. - Watch out for Fake Shopping Apps

Similar to “phishing” emails that look like they’re from legitimate stores, these counterfeit apps — complete with an authentic-looking logo and marketing messaging — want your credit card information to steal your identity. Some have been found to contain “malware” (malicious software) that can also infect a mobile device, while others ask you to log in with Facebook credentials to lift personal data.Be sure you’re downloading the legitimate app by getting it from the company’s official website or, if downloading from an app store directly, check to see it’s been around for a few years and has high ratings from many users. Never be the first to download a new shopping app.If you’re interacting with brands on social media, make sure they’re “verified,” with the little blue checkmark by their profile, which means the company is legit.

- Think Before You Click

-

-