LACKAWANNA COUNTY -- A 50-year debate in Lackawanna County has been boiled down to one sentence. Lackawanna County Commissioners settled on the wording of a referendum question that will ask voters if there should be a county-wide tax reassessment.

The referendum question will appear on the ballot on Election Day on November 7. The commissioners decided to put the 50-year debate into the voters' hands: should Lackawanna County do a property tax reassessment?

A property tax reassessment in Lackawanna County would affect anyone who owns a home, we just don't know how. Your taxes could go up or your taxes could go down. The decision is yours.

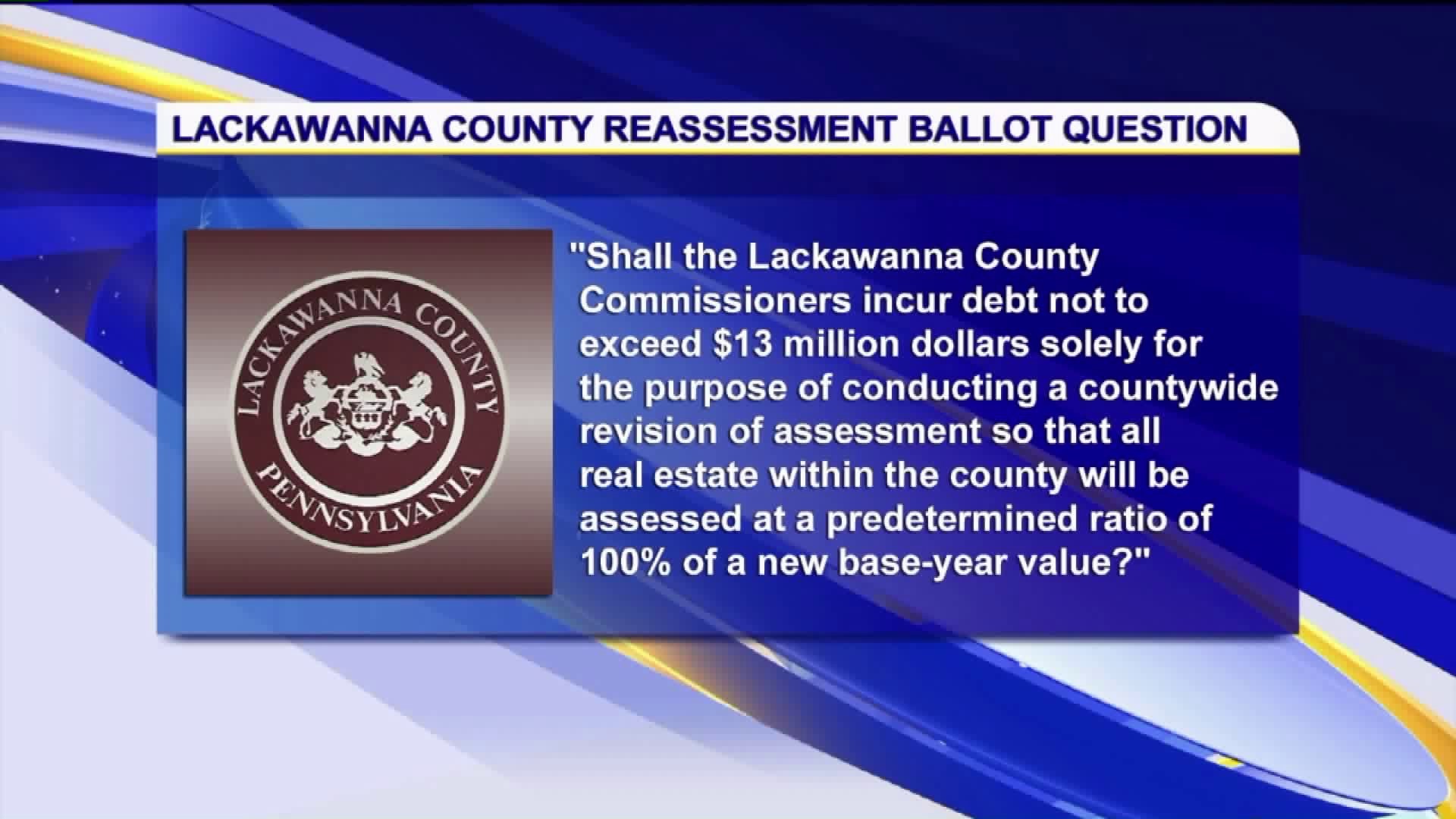

Here's how the referendum will appear on the November ballot:

"Shall the Lackawanna County Commissioners incur debt not to exceed $13 million solely for the purpose of conducting a county-wide revision of assessment so that all real estate within the county will be assessed at a predetermined ratio of 100% of a new base-year value?"

"When that question is asked, basically the first 10-15 words of the sentence is `do you want the county to incur debt?` I think most people are going to stop right there and just say no, they don`t want the county to incur debt," said real estate broker Phil Godlewski.

Godlewski hopes the reassessment question does not pass. He thinks it will ultimately lead to fewer people buying homes. Godlewski said that happened when Luzerne County reassessed ten years ago.

We posed the referendum question to Diane Praschak whose family has owned her home in Taylor since 1916.

"I think it should have been done earlier, and I don`t think the people in the area are fully aware of what`s going to happen. I`m afraid it`s going to, the taxes will go way up," Praschak said.

Homeowners won't know which way their reassessment will go until it's done.

Praschak thinks the wording of the referendum means that it won't be done, at least for now.

"Nobody wants to spend more money on something they don`t want to pay. So, of course, the people are going to say no. But, if it`s a necessity, then they should go up," Praschak added.

Advocates for reassessment say it makes taxing rates more fair. Most states in the country require it be done every several years. It hasn't been done in Lackawanna County since the 1960's.

Lackawanna County officials say there will be educational seminars about reassessment ahead of Election Day.